- Oscar Bronze Classic Pcp Copay 2020

- Oscar Bronze Classic Pcp Copay Cards

- Oscar Bronze Classic Pcp Copay Assistance

Oscar Bronze Classic Next 2. By Oscar Buckeye State Insurance Corp. Obamacare: Bronze: $0 / $0: $8,550 / $17,100: Price & Details: Oscar Bronze Classic PCP Copay. By Oscar Buckeye State Insurance Corp. Obamacare: Bronze: $6,000 / $12,000: $8,550 / $17,100: Price & Details: Oscar Silver Classic. Oscar Bronze Classic PCP Copay ($3 Prescription List + Free 24/. Out-Of-Pocket Max. Expanded Bronze.

Get 2021 health insurance plan info on Oscar Bronze Classic PCP Copay (None) from Oscar Health Plan, Inc. Of CO - premiums, out-of-pocket maximums, prescriptions, and more. Yahoo for mac messenger.

The Virginia Health Insurance Exchange (also referred to as a 'Marketplace') offers Open Enrollment for new and existing customers. Regardless of any pre-existing conditions, individuals, families and small businesses can apply for affordable medical coverage in Virginia from the top-rated companies. You can not be denied for medical conditions, and a special federal subsidy helps reduce premiums. Unless otherwise notified, you may keep the existing private plan you have, or change policies.

About 900,000 Va residents are currently without coverage. About 800,000 persons are eligible for government assistance, either through the State Exchange or the expansion of Medicaid, if approved in the future by legislation. Raising the Federal Poverty Level requirements would allow more persons to qualify for low-cost (sometimes free) Medicaid. However, many states that have improved Medicaid expansion have seen costs rise, which is wreaking havoc on budgets.

Preventative benefits are included on all policies without any out-of-pocket expense, waiting period, or deductibles to meet. Once your plan is effective, annual routine physicals, OBGYN visits, Paps, and mammograms may be immediately scheduled. Many shots, screenings, and other procedures are covered for both adults and children. Pediatric dental benefits are also typically covered, although adult dental benefits must be purchased separately. Additional ancillary plans can be purchased from Anthem, Humana, UnitedHealthcare, and many other carriers that do not offer individual healthcare plans.

What Type Of 2021 Plans Are Available?

There are four available types of policies. They are Platinum, Gold, Silver and Bronze. The expected percentage of medical claims covered under each policy is 60%, 70%, 80% and 90% respectively. The Platinum is the 'Cadillac' of the four choices, offering the lowest out-of-pocket costs if you have a claim. The Bronze plan is the cheapest option, but you will incur higher charges when you submit a claim. However, it can be a big money-saver for persons that desire low premiums but are willing to assume more risk. NOTE: 'Unreasonable premium increases' have reduced since the passage of the ACA legislation. The maximum allowed deductible is $8,550.

Also, a 'Catastrophic' option is available for younger persons (under age 30) and applicants that have special financial needs. These policies are cheaper than other Metal plans, but feature much lower benefits. You must be under age 30 to qualify for this type of low-cost plan. Exceptions are made if you meet specific financial hardship exceptions. Some examples include recently filing for bankruptcy, large unpaid medical bills, homelessness, victim of domestic violence, recent fire, flood or other natural disaster, death of a close family member, and your utilities have been shut off.

Often, Bronze-tier plans are less expensive than catastrophic plans, since a federal subsidy may be available. The reduction in premium is often thousands of dollars each year. Also, Bronze-tier plans typically offer unlimited office visit benefits, instead of capping the number of covered visits to three.

NOTE: If you qualify for a subsidy and your income does not exceed 250% of the Federal Poverty Level, a Silver-tier plan may be a better option than a Bronze or catastrophic option. 'Cost-sharing' is only offered on Silver plans, and often allows you to dramatically reduce deductibles and copays. In those situations, it is much more cost-effective to select the Silver contracts. However, if your income significantly increases the following year, reviewing all options is recommended.

Company And Plan Requirements

Companies offering Virginia health insurance plans through the Marketplace include CareFirst Blue Choice, Cigna, CareFirst BCBS, HealthKeepers (Anthem), Kaiser, Optima, Piedmont, Optimum Choice, UnitedHealthcare, and Oscar. Oscar began offering plans in the Richmond area last year. The number of available companies has remained at nine from three yeas ago.

Aetna, and Innovation Health no longer offer private individual and family Marketplace coverage. However, the Aetna PPO network is used for several short-term plans. Virginia Premier has exited the state and Optimum Choice is new for 2021. Many carriers offer non-Obamacare plans, Group, Senior, and ancillary plans. Dental and vision coverage can be purchased as stand-alone products.

Each carrier must offer at least one Silver and Gold plan inside the State Exchange. By making these two options available, carriers are allowed to sell coverage 'away' from the Exchange. Sometimes, contracts outside of the Marketplace will feature larger networks of doctors, specialists and hospitals with more competitive pricing (assuming you don't qualify for a subsidy). However, no subsidy applies, so generally, lower income households should not consider these policies. There also may be lifetime benefit caps, ranging from $100,000 to $2 million. Temporary plans also are only available from selected carriers.

Compliant plans are 'standardized,' and contain very similar core benefits. The federal government, when passing 'The Affordable Care Act,' felt there were too many choices for consumers to properly make an informed decision. A set of 'essential health benefits,' or core coverage, must be included in all policies. Some of the prominent benefits include maternity, prescription drugs, preventive benefits, hospitalization, and mental health. Pediatric dental benefits are also required to be included, although coverage is basic.

You can not enroll in a Marketplace plan in Virginia unless it contains these 10 mandated benefits. If any are missing, the policy is 'non-compliant,' and you are subject to the special tax-penalty since you are considered 'uninsured.' Many student plans offered by colleges and universities previously did not meet meet these requirements until their grandfathering period ended. Therefore, Va Exchange options for students became very popular. Although these options are still popular, University plans must now contain these required benefits.

Non-Compliant Options

Previously, policies that did not meet Obamacare requirements were subject to the 2.5% household income tax penalty. However, in certain situations, paying the tax was offset by the substantial savings of the plan premiums. But there was often an unusually high deductible, which could increases maximum out-of-pocket expenses to $8,150. 'Short-term' plans are non-compliant have never been subject to this penalty. If you miss Open Enrollment and are not eligible for a 'Special Enrollment Period' exception, they should be strongly considered since they are very cheap and can provide benefits until the next eligibility period.

Note: The non-compliant 2.5% penalty no longer applies. This unpopular charge was removed last year, which created an opportunity for many carriers to offer specialized low-cost plans to healthier prospects. Temporary plans (see below) have become popular when the Open Enrollment deadline is missed. Several carriers offer customized plans, with many levels of coverage available. Indemnity and PPO options are available from several companies.

Student Health Insurance Rates In Virginia Should Be Cheaper

If only a few months of benefits are needed, then temporary medical plans would be the most appropriate. They will get you from Point A to Point B without putting a big dent in your budget. Prices are often about one-half to one-third the cost of a standard plan. But, as earlier discussed, since they are not ACA-approved, pre-existing conditions are not covered, and lifetime or annual benefits are capped between $100,000 and $2 million.

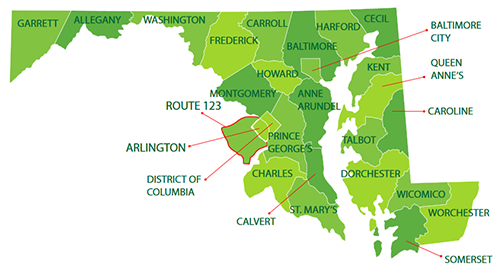

Virginia Rating Areas

Individual and small group plans are offered in 12 geographic rating areas. Generally, participating Marketplace companies do not offer plans in all parts of the state. Prices will also vary from one county to another. The 12 areas are listed below:

1. -- Blacksburg

2. -- Charlottesville

3. -- Danville

4. -- Harrisonburg

5. -- Bristol

6. -- Lynchburg

7. -- Richmond

8. -- Roanoke

9. -- VA Beach

10. -- Washington/Arlington/Alexandria

11. -- Winchester

12. -- Non-MSA

Under-65 plans are available in the areas designated below:

CareFirst BlueChoice -- Area 10

Cigna -- Areas 7, 10, and 11

Group Hospitalization And Medical Services -- Area 10

HealthKeepers -- All Areas

Kaiser -- Areas 7, 10, and 12

Optima Health Plan -- Areas 2, 4, 7, 9, and 12

Oscar -- Area 7

Piedmont -- Areas 2, 3, 6, and 12

Are The Same Policies Offered In All Counties?

No. The SCC Bureau approves all policies in advance, and each year, new options are added. Separately, there are six options for small businesses. The vast majority of areas can choose among three or four options. But although there are still some specific areas where only a single policy can be chosen (The Southwestern part of the state), additional carriers, with the help of new legislation, could enter the marketplace by 2021. For example, in the Richmond area, only one company (Cigna) is available, although many other non-Obamacare options are offered.

In the Charlottesville, Norfolk, and Virginia Beach areas, only Optima Health offers plans. However, in Arlington, four options are offered, with plans available from CareFirst BlueChoice, CareFirst BlueCross BlueShield, Cigna, and Kaiser. Availability in other cities: Roanoke -- Anthem Healthkeepers, Jamestown -- Cigna, Williamsburg -- Optima, Alexandria -- CareFirst BlueChoice, CareFirst BCBS, Cigna, and Kaiser, and Fredericksburg -- Kaiser. Additional carriers offer non-Exchange and ancillary plans. Senior Medigap options, including Supplement, Advantage, and Part D prescription drug plans, are available through many additional companies.

How And When Do I Buy A Policy

There is a standard online application that takes about 10-20 minutes to complete utilizing double-redirect software. Additional good news is there are no medical questions! You can apply for coverage through our website by first requesting a quote near the upper portion of this page. Your eligibility is virtually guaranteed and you can apply alone or with live assistance. The choice is yours. Of course, there are no fees or extra charges to pay. There are also no associations that are required to join.

During the enrollment process, only basic information is needed, such as your name, address, phone number, email address, and dates of birth of all persons applying for coverage. Social security number and the name of the plan you are applying for will also be needed. And finally, if you are requesting a federal subsidy to reduce the rate, household income and employment information may be needed. Occasionally, citizenship may have to be verified if you recently moved to the US or Virginia.

If you are eligible for Medicaid or Medicare, there is a separate enrollment process. Medicaid eligibility guidelines have been expanded for lower-income residents of the state. Children may also be able to qualify for special low-cost or no-cost programs. The Department Of Medical Assistant Services administers Medicaid and CHIP, which is also known as FAMIS. There are both financial and non-financial requirements. Federal subsidies for Marketplace coverage is not available for applicants that qualify for Medicaid or CHIP.

Several of the benefits provided by FAMIS include vaccinations, doctor and well baby checkups, hospital visits, prescription drugs, x-rays, lab tests, vision and dental care, mental health, and emergency treatment. There are no upfront fees or monthly premiums to pay. Copays for many services are $2 or $5. Some of these services include: home health, family planning, ER, clinic, chiropractic, outpatient hospital, lab and x-ray, medical equipment, medical transportation, outpatient mental health and substance abuse, physical, occupational, and speech therapy, prescription drugs, and private duty nursing.

Preventative benefits are generally covered in full. Children may apply for enrollment if they reside in Virginia, are under age 19, are a US Citizen (or legally-residing immigrant), and reside in households that meet the FAMIS income requirements. Family annual income limits are $25,605 for one person, $34,666 for two persons, $43,727 for three persons, and $52,788 for four persons. A screening tool is available to help determine if children meed eligibility requirements.

The regular Marketplace Open Enrollment period began November 1st and ended December 15th. However, there are specific circumstances (triggering events) that will allow you to apply at any time. For instance, getting married, getting divorced, giving birth, or adopting a child will all qualify. If you wish to change from one Metal plan to another, (Bronze to Gold, Platinum to Silver etc..) you will have to wait until the next Open Enrollment. NOTE: These 'triggering events' create an SEP (Special Enrollment Period) exception.

Virginia Health Insurance Marketplace Plans

Not all companies offer coverage in every county. Rates also vary, depending upon your age, county of residence, smoking status, and household income (federal subsidy eligibility). 'Catastrophic' plans are available to applicants under age 30, or any person that meets 'financial hardship' guidelines.

Catastrophic Tier

Kaiser KP VA Catastrophic 8550/0/Vision -- $8,550 deductible with maximum out-of-pocket expenses of $8,550 and 0% coinsurance. First three pcp office visits covered at 100%. One pair of glasses, or initial purchase of contacts or pair of medically-necessary contacts are also covered.

CareFirst BlueChoice HMO Young Adult 8550 -- $8,550 deductible with maximum out-of-pocket expenses of $8,550 and 0% coinsurance. First three pcp office visits covered at 100%. Allowances are provided for lenses and glasses.

Anthem HealthKeepers Catastrophic X 8550 -- $8,550 deductible with maximum out-of-pocket expenses of $8,550 and 0% coinsurance. First three pcp office visits covered with a $40 copay.

Optima Health OptimaFit Catastrophic 8550 M -- $8,550 deductible with maximum out-of-pocket expenses of $8,550 and 0% coinsurance. First three pcp office visits covered with a $40 copay.

Oscar Secure -- $8,550 deductible with maximum out-of-pocket expenses of $8,550 and 0% coinsurance. First three pcp office visits covered with a $0 copay. One eye exam and dental checkup covered each year.

Bronze Tier

Anthem HealthKeepers Bronze X 8200 -- $8,200 deductible with maximum out-of-pocket expenses of $8,550 and 40% coinsurance.

Anthem HealthKeepers Bronze X 5500 -- $5,500 deductible with maximum out-of-pocket expenses of $8,550 and 35% coinsurance. Pcp office visits are subject to a $40 copay and the Urgent Care copay is $60. All prescription drugs are subject to the deductible and coinsurance.

Anthem HealthKeepers Bronze X 5900 For HSA -- HSA-eligible plan with $5,900 deductible and maximum out-of-pocket expenses of $7,000 and 35% coinsurance.

Anthem HealthKeepers Bronze X 5800 Online Plus -- $5,800 deductible with maximum out-of-pocket expenses of $8,550 and 30% coinsurance. Pcp office visits are subject to a $25 copay. The generic drug copay is $25 ($75 for mail-order).

Cigna Connect 7000 -- $7,000 deductible with maximum out-of-pocket expenses of $8,550 and 40% coinsurance.

Cigna Connect 6750 -- $6,750 deductible with maximum out-of-pocket expenses of $8,550 and 40% coinsurance. $30 pcp office visit copay. Urgent Care copay is $40. Preferred generic drug copays are $8 and $24.

Cigna Connect 5500 -- $5,500 deductible with maximum out-of-pocket expenses of $8,550 and 20% coinsurance. $40 pcp office visit copay. Urgent Care copay is $75. Preferred generic drug copays are $10 and $30.

Kaiser KP VA Bronze 6000/55/Vision -- $6,000 deductible with maximum out-of-pocket expenses of $8,550 and 35% coinsurance. $55 pcp office visit copay for first three visits. Lab test copay is $75, and generic drug copay is $35. $27 copay for mental health group therapy.

Kaiser KP VA Bronze 7500/40%/Vision -- $7,500 deductible with maximum out-of-pocket expenses of $8,550 and 40% coinsurance.

Kaiser KP VA Bronze 6900/0%/HSA/Vision -- $6,900 deductible with maximum out-of-pocket expenses of $6,900 and 0% coinsurance. Policy is HSA-eligible.

Oscar Bronze Classic -- $6,000 deductible with maximum out-of-pocket expenses of $8,550 and 50% coinsurance. One pcp office visit subject to a $50 copay, and the Urgent Care copay is $75. The generic Tier 1A drug copay is $3 ($25 for Tier 1B).

Oscar Bronze ClassicPCP Copay Plan -- $6,000 deductible with maximum out-of-pocket expenses of $8,550 and 50% coinsurance. $50 and $90 office visit copays, and the Urgent Care copay is $75. The generic Tier 1A drug copay is $3 ($25 for Tier 1B).

Oscar Bronze HDHP -- $5,200 deductible with maximum out-of-pocket expenses of $7,000 and 50% coinsurance. Policy is HSA-eligible.

Oscar Bronze ClassicNext Plan -- $0 deductible with maximum out-of-pocket expenses of $8,550 and 50% coinsurance. $35 and $100 office visit copays, and the Urgent Care copay is $75. ER copay is $1,150. The generic Tier 1A drug copay is $3 ($30 for Tier 1B). $200 copay for Tier 2 drugs.

Oscar Bronze ClassicNext 2 Plan -- $0 deductible with maximum out-of-pocket expenses of $8,550 and 50% coinsurance. $50 office visit copays, and the Urgent Care copay is $75. ER copay is $1,150. The generic Tier 1A drug copay is $3 ($30 for Tier 1B). $250 copay for Tier 2 drugs.

Optima Health OptimaFit Bronze 7200 40% Direct M -- $7,200 deductible with maximum out-of-pocket expenses of $8,550 and 40% coinsurance. $45 copay for first three pcp visits. Generic drug copay is $20 ($60 mail order)

Optima Health OptimaFit Bronze 6250 20% HSA Direct M -- HSA-eligible plan with $6,250 deductible and maximum out-of-pocket expenses of $6,900 and 20% coinsurance.

Piedmont Choice Bronze 8300 -- $8,300 deductible with maximum out-of-pocket expenses of $8,550 and 30% coinsurance.

Piedmont Choice Bronze 6000 -- $6,000 deductible with maximum out-of-pocket expenses of $8,550 and 30% coinsurance. $35 pcp office visit copay. Generic drug copays are $25 and $63 (mail order).

Piedmont Choice Bronze HSA 6200 -- HSA-eligible plan with $6,900 deductible and maximum out-of-pocket expenses of $6,900 and 35% coinsurance.

UnitedHealthcare Balance Bronze 3 No Copay PCP Visits -- $7,500 deductible with maximum out-of-pocket expenses of $8,550 and 50% coinsurance. $0 office visit copay for first three office visits, and the Urgent Care copay is $75. ER copay is $1,150. Tier 1 and Tier 2 drug copays are $20 and $30.

UnitedHealthcare Balance Bronze 3 No Copay Telehealth Visits -- $7,000 deductible with maximum out-of-pocket expenses of $8,550 and 50% coinsurance. $25 office visit copay for first three Telehealth office visits, and the Urgent Care copay is $75. ER copay is $1,150. Tier 1 and Tier 2 drug copays are $20 and $30.

UnitedHealthcare Value Bronze -- $6,500 deductible with maximum out-of-pocket expenses of $8,550 and 40% coinsurance. $25 office visit copay for pcp office visits, and the Urgent Care copay is $75. Tier 1 and Tier 2 drug copays are $20 and $30.

Silver Tier

Anthem HealthKeepers Silver X 6250 -- $6,250 deductible with maximum out-of-pocket expenses of $8,550 and 35% coinsurance. Pcp office visits are subject to a $35 copay. Urgent Care copay is $55. Generic drug copay is $20 ($60 for mail order), and preferred brand and non-generic drug copays are $60 ($180 for mail-order).

Anthem HealthKeepers Silver X 5000 Online Plus -- $5,300 deductible with maximum out-of-pocket expenses of $8,550 and 25% coinsurance. Pcp office visits are subject to a $20 copay. Generic drug copay is $20 ($60 for mail order), and preferred brand and non-generic drug copays are $60 ($180 for mail-order).

Anthem HealthKeepers Silver X 2200 -- $2,200 deductible with maximum out-of-pocket expenses of $8,550 and 30% coinsurance. Pcp office visits are subject to a $35 copay. The Urgent Care copay is $55. Generic drug copay is $20 ($60 for mail order), and preferred brand and non-generic drug copays are $60 ($180 for mail-order).

CareFirst BlueChoice HMO HSA Silver 3000 -- HSA-eligible plan with $3,000 deductible and maximum out-of-pocket expenses of $6,650. $30 and $40 office visit copays after deductible has been met.

CareFirst BluePreferred PPO HSA Silver 3000 -- HSA-eligible plan with $3,000 deductible and maximum out-of-pocket expenses of $6,650. $30 and $40 office visit copays after deductible has been met.

Kaiser KP VA Silver 6500/40 Vision -- $6,500 deductible with maximum out-of-pocket expenses of $8,550 and 35% coinsurance. $40 and $70 office visit copays with $70 Urgent Care copay. Generic and preferred brand drug copays are $30 and $65.

Kaiser KP VA Silver 5000/40 Vision -- $5,000 deductible with maximum out-of-pocket expenses of $8,550 and 35% coinsurance. $40 and $60 office visit copays with $60 Urgent Care copay. $70 copay for diagnostic tests. Generic and preferred brand drug copays are $30 and $60.

Kaiser KP VA Silver 2500/35 Vision -- $2,500 deductible with maximum out-of-pocket expenses of $8,250 and 35% coinsurance. $35 and $55 office visit copays with $55 Urgent Care copay. $70 copay for diagnostic tests. Generic and preferred brand drug copays are $20 and $60.

Cigna Connect 7000 -- $7,000 deductible with maximum out-of-pocket expenses of $8,550 and 40% coinsurance.

Cigna Connect 6500 -- $6,500 deductible with maximum out-of-pocket expenses of $8,550 and 40% coinsurance. $20 pcp office visit copay. Urgent Care copay is $30. Preferred generic drug copay is $4 ($12 for 90-day mail order). Generic drug copays are $20 and $60. Preferred brand drug copays are $60 and $180.

Cigna Connect 3500 -- $3,500 deductible with maximum out-of-pocket expenses of $8,550 and 40% coinsurance. $25 and $75 office visit copays. Urgent Care copay is $35. Preferred generic drug copay is $5 ($15 for 90-day mail order). Non-preferred generic drug copays are $25 and $75. Preferred brand drug copays are $75 and $225.

Optima Health OptimaFit Silver 6600 30% Direct M -- $6,600 deductible with maximum out-of-pocket expenses of $8,550 and 30% coinsurance. $25 and $50 office visit copays (Tiers 1 and 2). Generic and preferred brand drug copays are $20 and $50 ($60 and $150 mail order).

Optima Health OptimaFit Silver 4600 30% Direct M -- $4,600 deductible with maximum out-of-pocket expenses of $8,550 and 30% coinsurance. $25 and $50 office visit copays (Tiers 1 and 2). Generic and preferred brand drug copays are $15 and $50 ($45 and $150 mail order).

Optima Health OptimaFit Silver 3000 25% Direct M -- $3,000 deductible with maximum out-of-pocket expenses of $8,550 and 25% coinsurance. $40 and $80 office visit copays (Tiers 1 and 2). Generic and preferred brand drug copays are $15 and $50 ($45 and $150 mail order).

Oscar Silver Classic -- $6,000 deductible with maximum out-of-pocket expenses of $8,000 and 40% coinsurance. $30 and $75 office visit copays. $50 Urgent Care copay. Generic drug copay is $3 ($7.50 for mail order), and preferred brand drug copay is $100 ($250 for mail-order).

Oscar Silver Classic Copay -- $7,000 deductible with maximum out-of-pocket expenses of $8,200 and 50% coinsurance. $30 and $75 office visit copays. $50 Urgent Care copay. Generic drug copay is $3 and $25, and preferred brand drug copay is $75.

Oscar Saver Silver -- $4,200 deductible with maximum out-of-pocket expenses of $8,550 and 50% coinsurance. $25 pcp office visit copay. Generic drug copay is $3 and preferred brand drug copay is $75.

Oscar Silver Classic $0 Ded -- $0 deductible with maximum out-of-pocket expenses of $8,550 and 50% coinsurance. $25 and $80 office visit copays. $50 Urgent Care copay. Generic drug copay is $3 and preferred brand drug copay is $100.

Piedmont Silver 6500 -- $6,500 deductible with maximum out-of-pocket expenses of $8,550 and 30% coinsurance. $35 pcp office visit copay. Generic drug copay is $25 ($63 for mail order), and preferred brand drug copay is $65 ($163 for mail-order).

UnitedHealthcare Balance Silver 3 No Copay PCP Visits -- $6,000 deductible with maximum out-of-pocket expenses of $8,550 and 25% coinsurance. $0 office visit copay for first three office visits (and telehealth), and the Urgent Care copay is $75. ER copay is $500 (after deductible). Tier 1 and Tier 2 drug copays are $10 and $20. The Tier 3 drug copay is $80.

UnitedHealthcare Value Silver -- $5,000 deductible with maximum out-of-pocket expenses of $8,550 and 35% coinsurance. $25 pcp office visit copay and the Urgent Care copay is $75. ER copay is $500 (after deductible). Tier 1 and Tier 2 drug copays are $10 and $20. The Tier 3 drug copay is $80.

Gold Tier

Anthem HealthKeepers Gold X 2000 -- $2,000 deductible with maximum out-of-pocket expenses of $8,550 and 20% coinsurance. Pcp office visits are subject to a $25 copay. $50 Urgent Care copay. Generic drug copay is $10 ($30 for mail order), and preferred brand and non-preferred generic drug copays are $40 ($120 for mail-order).

Piedmont Gold 1800/35/60 -- $1,800 deductible with maximum out-of-pocket expenses of $8,550 and 20% coinsurance. $25 pcp office visit copays. Generic drug copay is $15 ($38 for mail order), and preferred brand drug copay is $50 ($125 for mail-order).

Kaiser KP VA Gold 1700/25/Vision -- $1,700 deductible with maximum out-of-pocket expenses of $8,550 and 30% coinsurance. $25 and $60 office visit copays with $60 Urgent Care copay. Generic and preferred brand drug copays are $15 and $60.

Kaiser KP VA Gold 1250/20/Vision -- $1,250 deductible with maximum out-of-pocket expenses of $7,500 and 35% coinsurance. $20 and $40 office visit copays with $40 Urgent Care copay. Diagnostic test copay is $65 and generic drug copay is $10. The preferred brand drug copay is $50.

Kaiser KP VA Gold 0/20/Vision -- $0 deductible with maximum out-of-pocket expenses of $6,950 and 35% coinsurance. $20 and $40 office visit copays with $40 Urgent Care copay. Diagnostic test copay is $65 and generic drug copay is $10. The preferred brand drug copay is $55.

Cigna Connect 1500 -- $1,500 deductible with maximum out-of-pocket expenses of $8,550 and 25% coinsurance. $25 pcp office visit copay. Urgent Care copay is $50. Preferred generic, non-preferred generic, and preferred brand drugs must meet 25% coinsurance. Non-preferred brand drugs must meet 50% coinsurance.

Cigna Connect 2000 -- $2,000 deductible with maximum out-of-pocket expenses of $8,000 and 25% coinsurance. $20 and $65 office visit copays. Urgent Care copay is $40. Preferred generic, non-preferred generic, and preferred brand drugs are subject to $8, $20, and $50 copays ($24, $60, and $150 mail order). Non-preferred brand drugs must meet 50% coinsurance.

CareFirst BlueChoice HMO Gold 1750 -- $1,750 deductible with maximum out-of-pocket expenses of $6,650. $0 and $30 office visit copays. Urgent Care copay is $50. Lab test copay is $15 at non-hospital facilities. The generic drug copay is $0.

Optima Health OptimaFit Gold 1600 15% Select CH M -- $1,600 deductible with maximum out-of-pocket expenses of $8,550 and 15% coinsurance. $30 and $60 office visit copays. Generic and preferred brand drug copays are $15 and $40 ($45 and $120 mail order).

Optima Health OptimaFit Gold 1300 20% Direct M -- $1,200 deductible with maximum out-of-pocket expenses of $8,550 and 20% coinsurance. $35 and $65 office visit copays. Generic and preferred brand drug copays are $15 and $40 ($45 and $120 mail order).

Oscar Gold Classic -- $2,500 deductible with maximum out-of-pocket expenses of $6,000 and 30% coinsurance. Office visit copays are $30 and $55. $75 Urgent Care copay. Generic and preferred brand drug copays are $3 and $55 ($7.50 and $138.50 mail-order).

Platinum Tier

Kaiser KP VA Platinum 0/15/Vision -- $0 deductible with maximum out-of-pocket expenses of $4,000. $15 and $20 office visit copays with $20 Urgent Care copay. Diagnostic test copay is $20 and generic drug copay is $5. The preferred brand, non-preferred brand, and specialty drug copays are $35, $55, and $150.

Who Is Operating The Program?

The federal government is running the show, which is not unusual. Because of the large cost of handling the entire operation and transformation, many states are saving hundreds of millions of dollars by allowing the federal government to operate their Exchange. The same applies to smaller businesses (less than 100 employees). The 'SHOP' Exchange offers coverage and gives employers an opportunity to select among numerous options. If you do not own a small business, there is no reason to utilize the SHOP Marketplace.

Virginia is involved with some of the management of plans, but essentially plays a backseat role. However, in the future, if the state government chooses, they can request to operate the Virginia Health Exchange Marketplace and take over the operation. Previously, Governor McDonnell discussed legislation regarding the state's role, but no vote ever took place. Typically, because of the cost, individual states do not operate their own programs. Also, with anticipated changes and tweaks likely to the ACA Legislation, the future of the Marketplace is uncertain. It is anticipated that in 2022, individual states may be given more authority to offer customized plans.

Easily Apply For Virginia Health Exchange Plans

What Are Navigators And Why Did Our State Get So Much Money For Them?

'Navigators' are not experienced licensed brokers that can compare and recommend the best plans for you. They are simply 'workers' that were previously hired to help with the enrollment process of uninsured consumers. They typically are not licensed and their qualifications are very vague. They also may have access to your personal financial information. And yes, $2.5 million dollars was originally spent on them, with the total figure rising for several years. Many budget-conscious residents of the state feel the funds should be spent elsewhere. Three years ago, more than $1 million was slashed from the navigator budget.

Although their role is flexible, we believe they can best serve residents of the state that either have no online access, or choose not to utilize the internet for comparing and applying for coverage. Also, it's possible that there are Virginia residents that do not have the needed transportation to travel, and will require an in-home visit. But experienced brokers along with their reputable and reliable websites continue to be the best resources for providing expert advice and customized recommendations.

Can I Keep The Policy That I Have Now?

Unfortunately, not everyone can keep their existing plan. If your policy was 'grandfathered,' (your carrier will notify you if it is), you can keep coverage without having to be forced to purchase new coverage. Although it will mean that your existing contract is lacking some essential mandated benefits, it still may be the best choice for you. NOTE: Your insurer can terminate the policy although written notification must be given. Pg music for mac. Most grandfathered plans were terminated six years ago, so very few of these types of plans remain. Some 'grandmothered' plans also are active.

Another possibility is that your current company discontinues the specific plan you own. Generally, you are notified between August and November, which allows you plenty of time to research and compare new available options with all carriers. You do not have to enroll in the substitute option recommended to you by your current insurer. Aetna and UnitedHealthcare opted to leave the private Marketplace four years ago, although they continue to offer Senior, Group, and ancillary products. UHC returned to the Marketplace in 2021.

Also, if your employer decides they are no longer offering medical coverage to their employees (and perhaps paying the fine instead), of course you would have to obtain new benefits. This specific risk was lessened a bit when the federal government waived the requirement four years ago for certain businesses to offer healthcare to its workers. Occasionally, part-time workers are offered 'Limited Benefit' plans or indemnity policies that don't contain the comprehensive benefits you may need. If qualified benefits are available, the employer likely is not contributing a significant amount to help pay the premium.

What Are The 'Cost-Sharing Plans?

These are found under the 'Silver' Metal category of policies and it's a relatively unknown perk you can easily qualify for. If you are receiving any portion of the subsidy, you may automatically qualify for special reductions to your deductibles, coinsurance, and copays. The maximum reduction is offered when the family Federal Poverty Level is less than 150%. FPL levels less than 200% will generate the next biggest savings.

Thus, if you are purchasing a policy with a $5,000 deductible, it's conceivable that it may be reduced to $2,000. Or perhaps $1,500 or lower. And other projected expenses would also reduce. Copays on prescriptions and office visits, Urgent Care visits and Emergency-Room visits often reduce by as much as 50%. It's a great way to save money throughout the year, but only the Silver options feature this benefit. Also, in many situations, the Silver-tier options are more attractive than Gold-tier options.

Illustrated below are several examples of the significant difference 'cost-sharing' makes, if you qualify.

A 40 year-old residing in Fairfax that earns $55,000, does not qualify for a subsidy. However, with income of $25,000, the subsidy reduces the deductibles on the KP VA Silver 5000/40/Vision plan from $5,000 to $0, the Cigna Connect 6500 plan from $6,500 to $0, and the CareFirst BlueChoice HMO HSA Silver 3000 plan from $3,000 to $0.

A 50 year-old residing in Richmond that earns $55,000, does not qualify for a subsidy. However, with income of $25,000, the subsidy reduces the deductibles on the Cigna Connect 6500 plan from $6,500 to $0, and the Cigna Connect 3500 plan from $3,500 to $500.

A 50 year-old married couple (two persons) residing in Norfolk that earn $70,000, do not qualify for a subsidy. However, with income of $32,000, the subsidy reduces the deductibles on the OptimaFit Silver 6600 30% Direct M plan from $6,600 to $600, and the OptimaFit Silver 6000 30% Direct M plan from $6,000 to $450.

Sample Health Insurance Rates In Virginia (Monthly)

Fairfax County -- 30-year-old with $34,000 income

$28 -- Cigna Connect 7000

$34 -- Anthem HealthKeepers Bronze X 8200

$42 -- Cigna Connect 6750

$47 -- Anthem HealthKeepers Bronze X 5500

$132 -- Cigna Connect 6500

Fairfax County -- 30-year-old married couple with $55,000 income

$89 -- Cigna Connect 7000

$100 -- Anthem HealthKeepers Bronze X 8200

$117 -- Cigna Connect 6750

$117 -- Anthem HealthKeepers Bronze X 5500

$296 -- Cigna Connect 6500

Prince William County -- 35-year-old with $38,000 income

$76 -- Cigna Connect 7000

$81 -- Anthem HealthKeepers Bronze X 8200

$90 -- Cigna Connect 6750

$91 -- Anthem HealthKeepers Bronze X 5500

$187 -- Cigna Connect 6500

Prince William County -- 35-year-old married couple and one child with $65,000 income

$30 -- Cigna Connect 7000

$46 -- Anthem HealthKeepers Bronze X 8200

$69 -- Cigna Connect 6750

$70 -- Anthem HealthKeepers Bronze X 5500

$322 -- Cigna Connect 6500

Virginia Beach County -- 40-year-old married couple with $55,000 income

$61 -- Anthem HealthKeepers Bronze X 8200

$103 -- Anthem HealthKeepers Bronze X 5500

$103 -- Anthem HealthKeepers Bronze X 5900 for HSA

$113 -- Anthem HealthKeepers Bronze X 5800 Online Plus

$283 -- Anthem HealthKeepers Silver X 6250

Virginia Beach County -- 40-year-old married couple and two children with $80,000 income

$32 -- Anthem HealthKeepers Bronze X 8200

$79 -- Anthem HealthKeepers Bronze X 5500

$99 -- Anthem HealthKeepers Bronze X 5900 for HSA

$115 -- Anthem HealthKeepers Bronze X 5800 Online Plus

$386 -- Anthem HealthKeepers Silver X 6250

Loudoun County -- 50-year-old with $45,000 income

$170 -- Anthem HealthKeepers Bronze X 7500

$194 -- Anthem HealthKeepers Bronze X 5250

$197 -- Cigna Connect 7000

$203 -- Anthem HealthKeepers Bronze X 6300

$352 -- Anthem HealthKeepers Silver X 6250

Chesterfield County -- 55-year-old married couple and one child with $70,000 income

$19 -- Anthem HealthKeepers Bronze X 7500

Guitar hero for mac os. $85 -- Anthem HealthKeepers Bronze X 5250

$111 -- Anthem HealthKeepers Bronze X 6300

$117 -- Anthem HealthKeepers Bronze X 4900 for HSA

$525 -- Anthem HealthKeepers Silver X 6250

Historical Virginia Exchange Rates

Least Expensive Silver-Tier Monthly Premiums (Richmond)

2017

$289 -- Aetna

$296 -- Cigna

$303 -- Anthem

$329 -- Kaiser

$333 -- UnitedHealthcare

$357 -- Piedmont

2018

$439 -- Cigna

$447 -- Kaiser

Oscar Bronze Classic Pcp Copay 2020

$497 -- Anthem

$572 -- Piedmont

$900 -- Optima

2019

$490 -- Cigna

$504 -- Virginia Premier Health Plan

$531 -- Anthem

$638 -- Kaiser

$674 -- Piedmont

$801 -- Optima

2020

$489 -- Anthem

$502 -- Cigna

$514 -- Virginia Premier Health Plan

$520 -- Oscar

Oscar Bronze Classic Pcp Copay Cards

$528 -- Optima

Oscar Bronze Classic Pcp Copay Assistance

$592 -- Kaiser